Redacted

15 May 2025,

Dear Madam,

Dear Sir,

Council tax premium consultation-impact assessment review.

I am Belgian and own a small flat in Millport, Isle of Cumbrae since December 2022.

This is my second home, my main home being located in Belgium.

This flat is 50m2 and under the eaves. I go there when I can, to enjoy the peace and quiet and the beauty of the landscape (I love nature). I've made some friends on the island and the community is very friendly.

When I heard the news of the tax increase, I was saddened and disappointed. The amount currently being proposed, 240 pounds a month is unaffordable for me.

I repeat, it is unaffordable for me. This tax to which must be added the broadband and the heating. I don't have a television.

The flat is a purpose-built flat and the other neighbours of the house also use their flat as a second home. The difference is that mine is under the roof (on the second floor), which means: reduced space in height, small galley kitchen (small fridge, no dishwasher, no washing machine, no extractor hood, no place for a wardrobe in the small bedroom ... ) because there is NO space. If I want to wash clothes, I go to the launderette.

Disappointed, I had to put the flat up for sale at the agency on the island. here's the link: Redacted

I have also written to Mr Mark Boyd in April.

You know I'm not rich at all. This is not a flat in London. And what's more, I'm a single mother now.

There have been at least a dozen visits of my flat since March, but there are 3 problems:

- The people who could buy it as a holiday home have the same problem with the tax as I do.

- People who are looking for a permanent home to live long-term on the island find it too small.

- Following the introduction of the tax, the number of properties for sale on the island soared.

So, people visit it and find it cosy, but I don't have any offer given the reasons I've just mentioned.

I add my voice to that of Redacted concerning this issue. The island depends on tourism. It is not just any island. It is a small island where a lot of old houses have been converted. The house in which my flat is located is old and in a conservation area.

I am very worried about not finding a buyer, which is a real problem for me at the moment. What would you suggest as a solution?

Thank you for reading me.

Yours sincerely,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Communities assessment review for Cumbrae

Date: 19 May 2025 10:48:32

Second homes tax

I would like to comment on this ill thought out plan for Cumbrae.

Most second homes are tiny and can be situated in attics totally unsuitable for full time family use.

Many of them have been handed down through generations of families.

The majority are owned by ordinary working class families and having to pay double tax will make ownership untenable for them.

The result will be flats flooding the housing market or being left empty which will not be saleable due to their small size and burden of the tax if bought as a holiday home.

This will mean a huge drop in income for the island and properties no longer being maintained.

This will also have a significant knock on effect lowering the price of family size homes.

Please take into account the devastating effects this will have on the island which already struggles to survive.

Redacted

Sent from my iPad

Sent from my iPad

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Communities Impact Assessment Review for Cumbrae

Date: 08 May 2025 12:06:55

Dear sir/Madam,

As an joint-owner of a second home in Millport, Cumbrae, I would like to add my voice to Redacted objections to the rise in council tax for second home owners. I have been visiting Cumbrae for over fifty years and have enjoyed staying in my family's holiday home for over thirty. The one bedroom flat was bought by my mum and passed down to her children, all of whom regularly use the flat with family and friends, thus contributing to the island economy, Like many flats on the island, it is expensive to heat, due to the age of the building, damp, lack of insulation and the fact that there is no mains gas on the island. It is fine for short-term stays, but would be a challenging flat to live in.

Cumbrae's economy relies on tourism and second home owners have a longer season than da trippers - not just buying from the shops but using maintenance and repair services.

Redacted estimates that the second home levy will cost Cumbrae's economy £500,000, money it can ill afford to lose.

I would like to reiterate Redacted response:

- Even though Cumbrae is a small island with a population of just 1,262, it has a disproportionate number of second homes - 30% of North Ayrshire's total. In contrast, 37% of second homes are on the mainland, which has a population of 133,413. This suggests the impact per capita on Cumbrae will be 74 times greater than on the mainland.

- The new tax will mean £500,000 is taken from the island economy each year. This is a large proportion of the island's £12.9 million annual income (compared to an economic output for the whole of North Ayrshire of approximately £2.4 billion). This represents a significant strain on a community which relies on tourism and the contributions of the second home owners.

- The impact assessment carried out by North Ayrshire Council highlights that 76% of the second homes on Cumbrae are in council tax band A and B. Many of these are small, older properties, often not suitable for full-time occupation by working families. This compares to just 37% council tax band A and B properties on the mainland. The Impact Assessment states: "There is a risk, which is probably more acute in Cumbrae, that this change could potentially lead to more housing supply for lower banded properties being available on the market and that this is not matched by an equivalent level of demand for such properties."

We argued that the Island Communities Impact Assessment hasn't been properly carried out because the National Islands Act states any changes need to take measures so that they don't damage an island community.

The only mitigation suggested by North Ayrshire Council involves allocating 10% of the additional revenue to affordable housing across the whole of North Ayrshire, with no specific provisions for Cumbrae. The Impact Assessment also suggests monitoring the policy's effects post-implementation, but with no strategies for improvement.

We are calling for a proper plan which recognises the impact this new tax will have on Cumbrae. At the very least, there should be a detailed study to assess the condition of the second homes on Cumbrae and to consider what can be done to make them suitable as long-term homes for working families. A programme of works will then be needed to upgrade the properties.

Yours,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Communities Impact Assessment Review for Cumbrae.

Date: 20 May 2025 08:09:21

I am writing regarding the above to question the long term impact of this ill thought out decision to double Council tax for second homes, without any thought for island communities. This island has approximately 50% of homes that are not main homes and the owners of these second homes contribute greatly to the economy of the island. In Cumbrae, in particular, we have had many things negatively affect the economy of the island in the last few years ( issues with ferries including losing our main ferry for 4 months last year, a building site of a town due to the flood defence program and poor weather during the 'season') and this is a further blow which could impact the businesses even further. I own a retail business on the island and have heard many second home owners discussing this and whether or not they can afford to keep their property on. Most of these properties are not suitable for families to live in anyway due to small size.

This seems to me to be a quick grab of cash without thought to the long term impact and I would welcome any review of this decision,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Consultation to review Council Tax on Second Homes

Date: 19 May 2025 17:41:17

Dear Sir/Madam

Consultation to review Council Tax on Second Homes

I recently read about this consultation and contacted North Ayrshire Councillors to ask about it. I understand that the consultation is being driven by residents of Cumbrae but feel that most of the arguments and concerns apply across North Ayrshire in relation to tourism and spending etc. My interest stems from our recently purchased second home in Largs, and given the fact we've now spent almost every weekend in Largs and Millport for the last 2 years, and our friends and family use our flat when we are not there, we feel we should know about, and contribute to discussions.

Despite 'some' opinion, people with small second homes in Ayrshire are not rich people, they are people like us, who have worked and saved for 30-40 years for this lifestyle change. We currently work very hard Tuesday to Friday in another authority, but are in our car to Largs by Friday afternoon to spend our hard-earned salary there, and on Mill port every weekend. We are also there during our holiday periods from work. We did not spend our savings on a flat so that we can go to Largs and sit home every night - exactly what we will have to do, to afford this extra tax. In truth, it is likely that we and many others will make the difficult decision to sell up as things stand. Will this really benefit Largs and the islands if we all sell these 'holiday homes'. We personally spent all of our savings transforming a really run-down, uncared-for flat into a lovely home, but is it really contributing to a shortage of suitable family homes in Largs - I would doubt it. We have already made lots of lovely new friends in Largs, we already support local causes and charity events, we already invest in the local area - eg committing to contributing financially towards new stones and flowers outside the front of our flats where the council used to pay for flowers. We have carefully planned to reduce our working commitments over the next few years in order to comfortably retire to Largs, therefore we obviously have a genuine interest in looking after and improving the local area.

I hope you agree it's appropriate for us to respond to the consultation and consider that a large number of second-home owners on Largs and their families, regularly frequent the local islands and contribute to the local economy. I think all interested parties should have been encouraged to make representation, but do not know about the consultation. I think it was a similar story in relation to the original 'consultation' to introduce the double tax -many people did not know, and therefore made no response. I'd also like to add that others who did know, did not understand, and still don't understand what 'double council tax' actually means. Once explained, people genuinely appear surprised and shocked that double Council Tax does not mean One tax on your main home and another One tax on your second home. We had to work very long and hard to pay off our mortgage before affording our flat, but are now paying the equivalent of a mortgage on 3 lots of Council tax - despite using very little of any service in either local authority.

Clearly we have a vested interest and hope that North Ayrshire Council looks at the long term effects, considering the positive impact that second home owners have on Largs and the islands, as opposed to being swayed by a quick cash injection which may be short-lived and significantly impact on local businesses and the local environment.

Yours sincerely

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Council Tax Charges on 2nd Homes - Island Communities Impact Assessment Review for Cumbrae

Date: 11 May 2025 14:46:12

Attachments: Proposed Council Tax Charges on 2nd Homes - Alan Hill.pdf, Proposed Council Tax Charges on 2nd Homes - Todd Ferguson.pdf

Dear Sir/Madam,

Attached are 2 emails (and a copy of my original email sent below) which I forwarded to Councillors Alan Hill and Todd Ferguson on 23rd June 2023 voicing my concerns regarding the second home levy being proposed by North Ayrshire Council at that date.

My concerns remain the same today now that the said second home levy has been agreed and introduced by the Council. The replies I received from both Councillors are also included in the attachments.

What I find disturbing is the change in Councillor Hill's view from 2023 to 2024.

Millport's position regarding the levy should have been properly considered and fully researched before any decision was reached to impose the rates penalty on the second home owners.

Regards,

Redacted

Copy Of My Original Email

I write regarding the above intention to penalise 2nd homeowners by potentially doubling Council tax.

My wife and I have been ratepayers for our property on Millport, Isle of Cumbrae for over forty years. We regularly visit the island using local shops, contractors and facilities of a place we consider to be as much as home as our main residence.

Our daughters have enjoyed going to Millport over the years rather than holidaying abroad. They have worked in local businesses and have both married Millport boys who continue to have family on the island.

We consider it outrageous that the SNP/Greens obsession to target ordinary working class ratepayers who have saved their earnings and bought 2nd homes to provide pleasure for their family.

What consideration has been given to:

1. The effect this increase will have on the local economy and tourism industry on which the island depends.

It is more than likely this increase will affect the pricing of holiday lets particularly over the summer months. Doubling the rates will only be added to the rental cost. Almost certainly this will impact on regular visitors who annually arrive for the summer months and subsequently local shops and businesses.

2. It is not clear from information available, whether the proposed legislation will include static caravans located at West Bay and Kirkton Caravan parks.

Again any increase would be devastating for summer rentals and owners.

3. My understanding is the main intention is to release 2nd homes into the housing market to deal with the shortfall in rural areas.

I would ask:

- who will have the funds to purchase these properties?

- how many people are looking for long term accommodation in Cumbrae?

- what evidence exists that additional incomers would find employment on the island?

- accommodation availability in the town over the years has risen and fallen as can be seen in the local estate agents adverts. There always seems to be properties for sale or rent.

- will the intended incomers be able to support their families from income generated on the island or will they require assistance with rent, rates and other outlays? If so how can this be cost effective?

4. Many 2nd homeowners are 3rd or 4th generation families who have a long term association with Millport and have supported the community for many years. Their ongoing involvement should be encouraged not finished by this legislation.

5. As a long standing member of Millport Golf club (40 years) and active for many years on the Committee, I can foresee major financial implications for a club that has been in existence since 1888.

With more than 70% of the membership being 2nd homeowners the likelihood will be the loss of long standing golfers who have had much pleasure from this unique, excellent test of golf in the most friendly of locations. With only around 120 members, even a small percentage loss of membership will be catastrophic for the club's finances and the potential closure of a major attraction of the island.

As active councillors I hope you would give serious consideration to object to this proposal and fight for the future of the island's economy. I assume North Ayrshire Council could opt out of this scheme if sufficient objections were received by local representatives.

I look forward to receiving your opinion and hopefully your support to reject this excessive increase.

If the contents of this letter need to be fo1warded to the appropriate authorities you have my permission to do so.

Yours faithfully,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

CC: Redacted

Subject: Cumbrae Council Tax Premium 2nd Consultation - Call for Contributions

Date: 18 May 2025 11:12:42

To Whom it May Concern,

My Husband and I are writing to you so that our views can be expressed with regards to the original decision by North Ayrshire Council to impose a 100% council tax premium on second homes on Cumbrae and the subsequent decision (by the council) to undertake a review of an island community impact assessment, in relation to this decision.

We own a much loved second home on the island and when we completed the first consultation (via the council website) we shared our concerns on the impact (to the community, as well as to ourselves), that this decision will cause to the island as a whole.

We fully agree with the following points taken from the call for contributions website:

- The policy will disproportionately affect Cumbrae's small community, where 30% of North Ayrshire's second homes are located.

- The estimated council tax premium on Cumbrae is projected to be £500,589, a staggering proportion of the island's total economic output of just £12.9 million.

- The policy will lead to small, difficult to heat flats, being put on the market that are not suited to full-time occupation by working families.

- Despite recognising these impacts, North Ayrshire Council has failed in their legal obligation to propose any mitigation of, or improvement to, the policy for our island community.

We also agree with Redacted request for proper mitigation measures that fully recognise the unique and particular circumstances on the island (which are totally different to all surrounding islands). And request at the very least, a detailed study of ALL second homes on Cumbrae to assess their condition and consider possible ways of altering /upgrading them (funded via the monies raised by the second home council tax) to make them suitable for permanent occupation by working families, if this is still considered to be a realistic was forward.

North Ayrshire Council also need to urgently review the potential economic impact and fallout (from implementation of the second home council tax) on the local business in and around Millport; where second homes owners, such as ourselves, contribute massively to the local economy on the island.

As increasing numbers of second home owners continue to choose to sell up (and they are doing with a noticeable increase of properties being listed for sale since this ridiculous decision has been made) it is ultimately the local community and economy on the island that will suffer as a result of the council imposing this decision, despite overwhelming opposition to it by permanent residents and second home owners, alike.

There is no doubt that in the long term this decision will be adverse for Cumbrae in terms of economic impact and long term prosperity of the island, as a whole.

From our own perspective (because of the 100% second home tax decision) we are currently considering our own position, recently having had an updated home report completed (with a view to potentially selling up).

We adore the island and the local community, having many close friends who permanently live in Millport and as second home owners we contribute hugely to the local economy by buying locally and eating and drinking out locally. It will be an absolute tragedy for the community if we and second home owners like ourselves leave the island in droves because of this ill thought out decision.

Because of the unique environment on the island we request that North Ayrshire Council fully considers our views on this matter; with our preferred option being that the planned 100% second home tax is scrapped indefinitely to secure the future of this tiny beautiful Scottish island and its community, which is so loved by everyone.

Thank you.

yours sincerely

Redacted

Sent from my iPhone

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Cumbrae Impact Assessment Review.

Date: 17 May 2025 11:02:45

The Greater Cumbrae second home owners should not have to pay higher council tax charges than any other second home owners in Scotland.

They may only spend a limited time on the island but they probably contribute more to the economy and local businesses while they are here that most of the permanent residents do.

Cumbrae's infrastructure would collapse if the number of permanent residents increased. It only has a small cottage hospital, one doctor, one small pharmacy which provide a stable and efficient service. More people living here would cause irrevocably damage unless the council were prepared to increase services proportionally to the rise in demand including a bigger hospital, more doctors, a dentist, a bigger school, a Lidl and a Primark. Also a completely revamped transportation system would be needed, new road, new buses, and means to cross over to the mainland.

So, be careful North Ayrshire, what you anticipate being a good thing for the community here, will end up costing you more in the long run. Because if services and facilities don't increase, the strain on what is in place just now will cause people to abandon Cumbrae all together.

Don't be greedy, leave the second home owners council tax rates the same as elsewhere in Scotland.

Regards

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Cumbrae Second Property Tax

Date: 05 May 2025 15:01:27

I am writing to strongly oppose the decision to impose double tax on second properties on Cumbrae. This is likely to result in surplus flats on the island which will inevitably fall into disrepair. It will limit visitors which we rely on economically and change the profile of the island community. This must be stopped.

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Double council tax for second homes on Cumbrae.

Date: 19 May 2025 20:47:58

I would like to bring the following points to the attention of the council. Second homes on Cumbrae make up a large proportion of the population of Cumbrae. Perhaps due to the proximity to urban areas, and the late night Friday ferry for part of the year, I believe Cumbrae is somewhat unique in its pattern of occupation by second home owners.

Unlike other " holiday " destinations which undoubtedly see scant usage of second homes, Cumbrae second home owners tend to utilise their holiday flats often, and out of the main holiday season. They contribute hugely to patronising pubs, restaurants and cafes on the island and their out of season attendance has been essential to keep facilities such as these, open over the autumn winter and early spring. While holiday makers tend to visit very infrequently during these months( and I can absolutely attest to this as I rent out a flat myself), second home owners are still very much in evidence.

They are the main attendees ( having a little more disposable income) at many events. They are the people at the Burns supper dance, the table top sales for the Pipe Band, the fund raising events run by pubs.

To decimate the population of second home owners will disproportionately affect a fragile and finely balanced economy which relies heavily on hospitality.

The accomodation on Cumbrae is ,almost exclusively, tenement accommodation. Often they are one bedroom, with poor EPC ratings, up several flights of stairs, and therefore not suitable for families.

Accommodation on the island is not particularly expensive. This belies the insistence that accommodation is beyond the ability of single people to buy and is scarce - it is not. It is however not particularly attractive to the demographic which NAC insists require accommodation.

I strongly believe that there should be a more nuanced and thoughtful approach to any perceived lack of accommodation, and publication of a study on unintended consequences of the double council tax.

Redacted

Sent from Outlook for Android

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Double council tax isle of cumbrae ref Island communities Impact Assessment Review for Cumbrae

Date: 19 May 2025 16:43:16

To whom it may concern

I would like to object to the implementation to the double council, not only to i find it morally wrong but I was given no notice of the increase to double until the bill arrived for the year. As a result of having this thrust upon me. I find i have to make sacrifices else where from my budget. I appreciate that you have a Budget to , but this feels like a money grab. To say it is for social house would be unbelievable given that NAC have built 6 amenity houses in Howard street and 28 at the new scheme over the span of 50 years That is 1 house per year. I am sure that the strategy of double council tax 200% bill for use of perhaps 25% occupancy does help your budget but not mine I do not wish to become a landlord in order to avoid the double tax, nor do i want to sell. As you are aware many of the homes here are not large enough for families to live in , and many of the air b and bs are serviced by wooden staircases, with no means of escape, which should not be habitable altogether.

Implications to Businesses on the Island

First I will be NOT shopping on the island, I will be bulk buying elsewhere

Secondly I will no longer be eating out in the cafes and restaurants

Thirdly we will no longer be visiting as often ie spending less money in the round

Yours Redacted

nt from Outlook

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Double Council Tax

Date: 09 May 2025 08:36:22

TO WHOM IT MAY CONCERN

I am writing to complain about the double council tax which has been imposed for people with a second home in Millport.

It is bad enough that we are charged full council tax when in my case the flat lies empty for at least 50% of the time as I live and work in Glasgow. I purchased my one bedroom flat (December 2022) when my mother was still alive who I lived with. The original idea was that it would be somewhere I would go for weekends to give us both a break from each other. However, unfortunately she passed away in January 2023 and now I am left with the two houses; one in Glasgow and one in Mill port. I found it tough enough being charged the 100% council tax especially as I say when the flat lies empty most of the time but now I am being charged 200% with the flat still remaining empty most of the time.

I understand it is meant to free up housing for families but as most of the flats involved are one bedroom flats - it doesn't seem to make sense that if I sell up and free my flat that a family would be able to live there.

I also understand that this is being looked at and I hope that it will be resolved and we will get a reprieve from the double council tax as if not, I will need to reconsider my options which it looks like a lot of people are doing.

Thank you

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Fw: Island Communities Impact Assessment Review for Cumbrae

Date: 07 May 2025 13:56:47

From: Redacted

Sent: 07 May 2025 07:36

To: legalpostbox@north-ayrshire.gov.uk

Subject: Island Communities Impact Assessment Review for Cumbrae

To whom it may concern

I am writing to express my opinion regarding the implementation of the second home tax on the Isle of Cumbrae.

My family have owned our small one bedroom flat in Millport for almost 70 years. This has been used down four generations for many a family holidays, long weekends and shorter breaks. We do not let the property. Until the recent changes we were paying approximately £1200 a year council tax. This has doubled after the change.

I fully understand the need to provide affordable housing to local people. I would content, however, that affordable housing is not an issue on the island. Moreover this move is likely to cause irreversible damage to the local economy for the following reason.

- Most second home in Millport are not suited for families and are built as holiday homes. So, at best there maybe a change of ownership as those who can't afford the increase sell up and new buyers move in. Demand will be high as Millport is becoming a desirable destination. Hence prices will more than likely increase.

- Many new buyers are looking to make financial gain from their properties Either through B&B lets or conversions to HMO's. Experience from all over Britain has shown the adverse effect this has on the local community. These buyers and or renters will bring no value to the local community.

- Given the long relationship many people who have second homes on the island and the financial impact they have This change will impact that. All you need to do is look at the impact similar taxation changes have had on communities in Cornwall and Wales. Multiply houses lying empty. No significant impact to house prices and local economies in crisis.

Finally I would also contend that if I am having to pay twice the rate for a second home Then I should be allowed to have a voting right in North Ayrshire So that my voice will be heard.

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Fw: Island communities impact assessment review

Date: 17 May 2025 14:09:21

Yahoo Mail: Search, organise, conquer

---Forwarded Message---

From: Redacted

To: "legalpostbox@northayrshire-council.gov.uk"

Cc:

Sent: Sat, 17 May 2025 at 11 : 18

Subject: Island communities impact assessment review

To whom it may concern

I write with disgust at the decision of introducing double council tax for second home owners on the island of Cumbrae. Many second home owners will be forced to sell or leave their holiday homes empty. They are not "rich" people and bring economy to the island. I make sure I shop, eat, socialise in Millport to ensure I support local economy, support business. You will absolutely devastate Millport if a u trun is not taken. Most of these homes are tiny flats and not suitable for permanent living with already problems with heating options and dampness. It will end with many empty homes falling into disrepair, local businesses having to close and residents having to leave the island. I beg a u turn is taken. These home owners choose to spend holidays, weekends and their money in Millport, Scotland, not abroad or elsewhere supporting this beautiful island and people.

Redacted

Yahoo Mail: Search, organise, conquer

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Fw: The Island of Cumbrae Communities Impact assessment Review

Date: 16 May 2025 16:41:10

Dear Sir/Madam

My name is Redacted, my contact number is Redacted I live Redacted

I am objecting to the double council tax that you have implemented for second homes or holiday homes.

I have been visiting Cumbrae for over 20 years, 2 and half years ago I decided I wanted to purchase a holiday home on the island, I saw a bit of Scotland's heritage for sale which is Redacted I decided to purchase the property for 3 reason, firstly I had somewhere to stay when visiting my favorite place in the world and secondly, I saw that Redacted was run down so I invested my time and money upgrading the property which I believe looks a lot better which also encourages tourist to visit the Island to see Redacted and thirdly, I had a long term view to move permanently to the Island however, the jobs market on the Island is not very favorable to someone that needs to be in employment. I also contribute to the Islands economy when I visit every month.

I was not expecting to pay double council tax when I purchased the property, Redacted is a tiny one bedroom house which if was still on the market would not be suitable for rental accommodation for a small family. I am regrettably considering if it is financially viable for me to continue to own or visit the Island given I already contribute to North Ayrshire Council.

Please consider this objection carefully and respectfully.

Regards Redacted

From: Redacted

Sent: Friday, May 16, 2025 4:36PM

To:

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Fwd: Island Communities impact assessment review for Cumbrae

Date: 18 May 2025 11:34:22

Sent from my iPhone

Begin forwarded message:

From: Redacted

Date: 17 May 2025 at 15:06:47 BST

Cc: Redacted

Subject: Island Communities impact assessment review for Cumbrae

I am a second home owner in the town of Millport. I've had my small one bedroom flat for 8 years now and I feel that myself and others in my very fortunate position are being unfairly and unjustly targeted by your council tax increase. The community of second home owners on cumbrae bring much needed cash to the local businesses and pay towards amenities such as refuse collection. My family and I use our home all year round and do not rent it out. We've become friends with many islanders, business owners and fellow second home owners and know that this increase in our council tax is a very unpopular subject. I now have £100 less in my purse to spend in the local shops, pubs and restaurants, which is a huge pity to those running and working in these places. I've also noticed a huge increase in properties going up for sale in the town as a direct result of the council tax increase. The majority of these properties could not support a couple or a family living permanently on the island as they are too small, but perfect for a few days or long weekends. I feel that the council has not thought well enough about the consequences of raising the council tax for second home owners and of the possibility of crashing an already fragile island economy in the process. I seriously hope that the council reverse this policy before any permanent damage is done to my favourite place on earth.

Yours sincerely

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Fwd: Island Communities Impact Assessment Review for Cumbrae

Date: 20 May 2025 15:52:37

---Forwarded message---

From: Redacted

Date: Mon, 19 May 2025, 23:49

Subject: Island Communities Impact Assessment Review for Cumbrae

To: <legalpostbox@north-ayrshirecouncil.gov.uk>

Dear Ayrshire Council,

The decision to impose double council tax on second homes in Millport is very short sighted and detrimental to the island community.

Actively trying to force second home owners to sell their properties by sanctioning a punitive 100% increase in council tax is counterproductive. North Ayrshire Council have openly stated that the majority of second homes in Millport are Band A and B tenement properties that are not desirable to Millport residents due to their smaller sizes and not being energy efficient (typically rated F and G in EPC terms). Second home owners are unable to apply for ECO grants to improve the energy efficiency of their properties.

My 2nd floor tenement flat, similar to many on the island, has been owned by my family and passed down through generations for over 25 years. It is used for family time to create memorable experiences and not leased out to generate income.

No consideration has been made as to where a second home owner is supposed to find an additional £1035.84 (in my case) from, to pay a bill that affords them no benefit. My pension has not suddenly increased by that amount and I would challenge the majority of council employees to find that amount from their wage packet in the current economic climate! It may have been more palatable if a significant amount was designated for affordable housing, however the council has the audacity to state that it guarantees only 10% towards that purpose.

When my family stay at our flat, we actively support the local economy by purchasing lunches and dinners out at the various cafes and restaurants. We deliberately buy supplies on the island rather that going to the supermarket in Largs. We use the various activities available such as bicycle and watersports hire and children's activities.

Ousting a large proportion of second home owners will mean a rapid decline in holidaymakers, who spend their hard earned income at the various businesses in Millport. How many small businesses will close due to this? How many of the 1,262 resident islanders will leave because there is insufficient income during the already short tourist season?

I urge North Ayrshire Council to reconsider the decision to target second homeowners and be mindful of the Islands (Scotland) Act 2018, which "...seeks to help create the right environment for sustainable growth". I strongly believe that the double council tax imposition will have the opposite effect on the Millport economy.

I look forward to hearing the results of this consultation.

Yours faithfully

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Impact assessment review for Cumbrae

Date: 20 May 2025 17:20:34

Dear sir or madam

I understand from Redacted that you are seeking consultation. I understand the concerns noted in relation to the volume of holiday homes on the Island and the additional cost to owners, however as a former holiday home owner and now permanent resident of Millport I'm not convinced that there will be a huge number of houses sold off by second home owners.

I suspect there is sufficient demand that the increased cost may not put many people off from paying the additional cost. I don't know what the cost on Cumbrae is, but I understand that the cost of annual fees for caravan owners can be high and this appears not to deter owners. It would be interesting to do a comparison for Cumbrae caravan site fees v council tax and perhaps this might help inform a decision? So I expect a wider review could be helpful.

In addition, second home owners have the option to rent out when not using to raise income and potentially cover the cost. I have experience of this myself. This wouldn't necessarily help a housing shortage but should bring in additional income to the island as I am aware that homes can lie empty for significant periods.

Of concern is the additional and increasing cost of the ferry charges and this might have an impact when combined with the higher rates.

Therefore I think a further review would be merited.

Yours faithfully

Redacted

It would also be interesting to find out the impact in other holiday towns of this policy.

Head of Democratic Services

North Ayrshire Council

Cunninghame House

Friars Croft

Irvine KA12 8EE

12 May 2025

Re: Second Homes Council Tax Consultation Dear Elected Representatives and Head of Democratic Services,

I am writing to express my deep concern and anger with regard to the imposition of double council tax on second home owners in North Ayrshire.

I am fully aware that there is concern about affordable housing in North Ayrshire which is apparently being addressed in some measure with new homes under construction. It is, in my opinion, a fallacy to equate second homes with affordable homes.

Was a detailed independent survey of second homes undertaken other than the counting the number prior to the decision to implement this double council tax levy?

Was any differentiation made between second homes used as holiday homes, available for 140 days per year, and those which are not holiday homes?

Were the implications of double tax on residents, businesses, economies, tourism and second home owners carefully considered?

It is my understanding that a property whose rateable value is less than £12,000 and becomes a holiday home subsequently becomes exempt from any council tax and owners reap the income from holiday lets.

Yet a second home not available as a holiday let is now required to pay 200% council tax. How can that be fair?

Those of us who do not offer our properties for holiday lets are the victims of unfair and unjust discrimination. We have paid 100% council tax, now 200%, contribute to the island economy, participate in island life and employ local tradespeople when required. We are left severely stressed and uncertain.

Since a number of second home owners are now applying for a licence to convert to holiday homes and become exempt from any council tax, will there be a recount of second homes paying 200% tax?

To add insult to injury, only 10% of income from 200% council tax is allegedly ring fenced for affordable homes.

This is simply taxation without representation and a breach of human rights.

Yours sincerely,

Redacted

Redacted

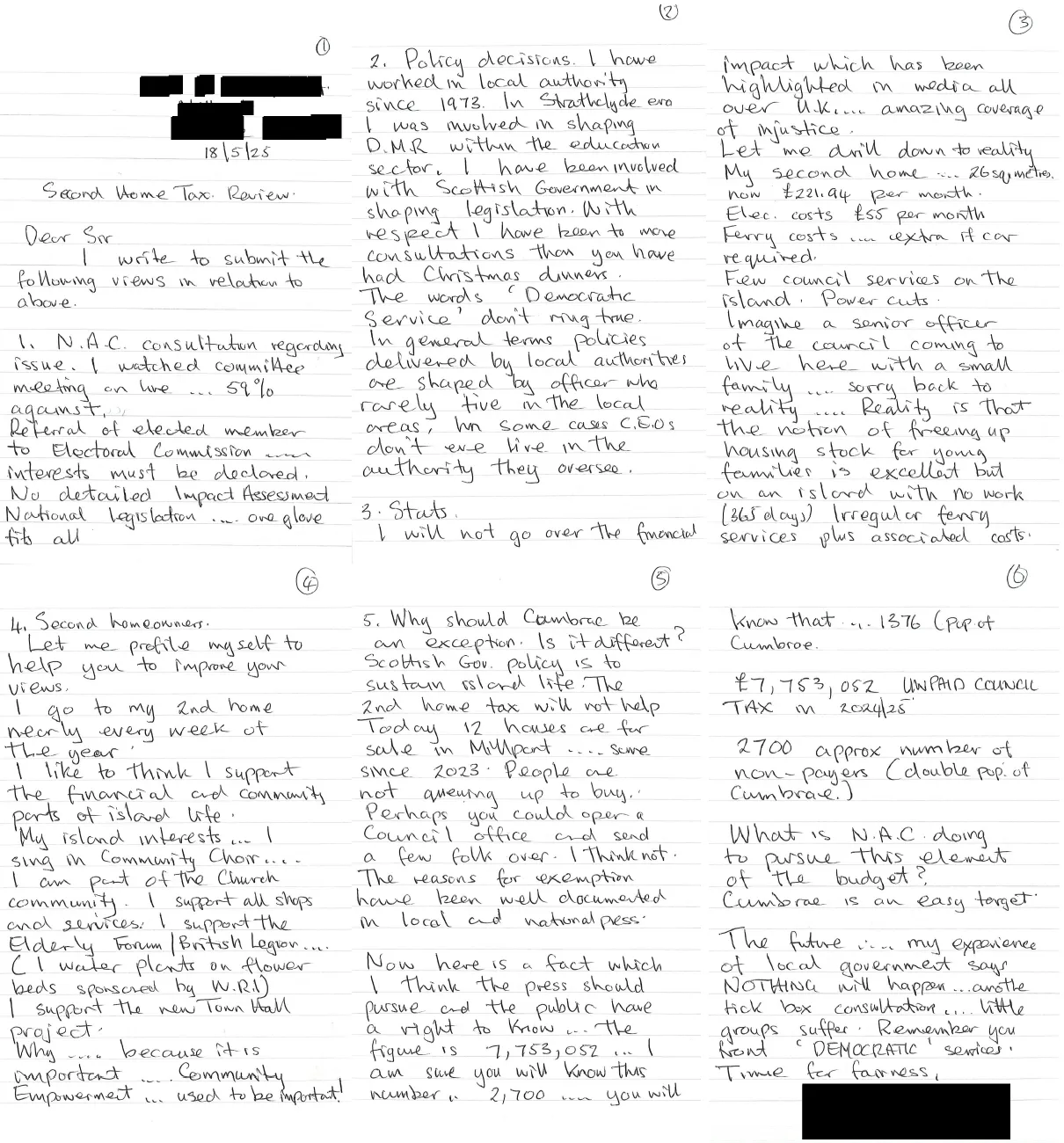

18/5/25

Second Home Tax Review

Dear Sir

I write to submit the following views in relation to above.

1. N.A.C. consultation regarding issue

I watched committee meeting on live ... 59% against. Referral of elected member to Electoral Commission ..... interests must be declared. No detailed Impact Assessment National legislation .... one glove sits all

2. Policy decisions

I have worked in local authority since 1973. In Strathclyde era I was involved in shaping D.M.R within the education sector. I have been involved with Scottish Government in shaping legislation. With respect I have been to more consultations than you have had Christmas dinners. The words 'Democratic Service' don't ring true. In general terms policies delivered by local authorities are shaped by officer who rarely live in the local areas, in some cases C.E.Os don't even live in the authority they oversee.

3. Stats

I will not go over the financial impact which has been highlighted in media all over U.K.... amazing coverage of injustice.

Let me drill down to reality My second home .... 26 sq metres now £221.94 per month.

Elec. costs £55 per month

Ferry costs .... extra if car required.

Few council services on the island, Power cuts.

Imagine a senior officer of the council coming to live here with a small family .... sorry back to reality .... Reality is that the notion of freeing up housing stock for young families is excellent but on an island with no work (365 days) Irregular ferry services plus associated costs.

4. Second homeowners

Let me profile myself to help you improve your views.

I go to my 2nd home nearly every week of the year.

I like to think I support the financial and community parts of island life. My island interests ... I sign in Community Choir .... I am part of the Church community. I support all shops and services. I support the Elderly Forum/British Legion.... (I water plants on flower beds sponsored by W.R.I) I support the new Town Hall Project.

Why .... because it is important ... Community Empowerment ... used to be important!

5. Why should Cumbrae be an exception. Is it different?

Scottish Gov policy is to sustain island life. The 2nd home tax will not help Today 12 houses are for sale in Millport .... some since 2023. People are not queuing up to buy. Perhaps you could open a Council office and send a few folk over. I think not. The reasons for exemption have been well documented in local and national press.

Now here is a fact which I think the press should pursue and the public have a right to know ... The figure is 7,753,052 ... I am sure you will know this number 2,700 .... you will know that ... 1376 (pop of Cumbrae).

£7,753,052 UNPAID COUNCIL TAX in 2024/25

2700 approx number of non-payers (double pop of Cumbrae)

What is N.A.C. doing to pursue this element of the budget? Cumbrae is an easy target.

The future .... my experience of local government says NOTHING will happen ... another tick box consultation ... little groups suffer. Remember you front 'DEMOCRATIC services'

Time for fairness,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island communities impact assessment review cumbrae

Date: 11 May 2025 15:18:27

Why did the council carry out the review then completely ignore the results? Cumbrae is a special case and should be treated as such - especially with regard to low value tenement properties. I was born and brought up in Millport and have had a second home there for a out 30 years.

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Cc: Redacted

Subject: Island Communities Impact Assessment Review for Cumbrae

Date: 20 May 2025 10:28:37

Redacted

20 May 2025

Dear Sir / Madam

Council Tax Premium Consultation and Island Communities Impact Assessment Review for Cumbrae

I refer to the recent introduction of Second Homes Council Tax.

As the owner of a very small studio flat (less than 200sq ft) in Cumbrae I am dismayed and disappointed at the introduction of a 100% increase in council tax.

I bought this property in 2001 when councils discounted council tax by 50% in order to increase occupancy of properties not suitable for permanent homes.

Since then we , as a family , have spent most weekends and holidays in Millport throughout the year, supporting the local community and economy by using shops, pubs, restaurants and attending community events. This financial support is particularly important to Millport during the winter months when day trippers, holiday makers or caravan owners do not visit the island.

With the increase in tax for second home owners this financial input will no longer be available and local businesses will suffer.

I understand that this premium is to try to increase affordable local housing stock but my property, and most of the second homes on Cumbrae would not be suitable for full time occupancy and there has never been a shortage of this type of property to buy at market value on the island.

I understand from your council meeting that this ' will be monitored' but it was not clear as to how and when this will be done and what exactly will be monitored.

I understand that Redacted has called for ' proper mitigation measures that recognise the particular circumstances on the island' and have asked that a detailed study of second homes be undertaken to consider if they could be suitable permanent homes for families . I fully endorse this request and support Redacted call for a Review of the Island Communities Impact Assessment with particular reference to Millport.

I look forward to hearing from you .

Yours faithfully

Redacted

My contact details are at the above address or

Redacted

Sena from my iPad

From: Redacted

To: Legal Postbox (shared mailbox)

Cc: Redacted

Subject: Island Communities Impact Assessment - Isle of Cumbrae

Date: 20 May 2025 19:56:17

I am writing, as an affected property owner, to request a full review of the North Ayrshire Council's process regarding the Island Communities Impact Assessment (ICIA) and its effect on the Isle of Cumbrae economy.

The implementation of the policy to impose a 100% surcharge on second homes was approved before the end of the statutory consultation period and assessment of the impact on the island community was not properly considered.

PROPERTY CONSIDERATIONS

With respect to our property, it is a small 1 bedroom flat in a subdivided property and is totally unsuited to permanent occupation as a family home, due to lack of bedroom space and almost total lack of storage.

The bedroom is suitable only for 2 beds in bunk bed format. The kitchen facilities are limited to a self contained hob, sink and fridge unit, with no oven facility included. Cooking is therefore very limited in scope.

The property has not been inspected by NAC prior to this policy being implemented. It would be clear that the property is unsuited for family accommodation, and can only be used for short term stays. It is not therefore depriving anyone, local or otherwise, from purchase as a family home for permanent residence.

In general, the lack of employment options on the island and total reliance on the ferry service/weather conditions for anyone working on the mainland would deter most people of working age to come to live on the island, and thus demand for family sized properties is limited.

The imposition of this additional charge will adversely affect the attractiveness of coming to the island, and this will therefore act to the detriment of the local businesses.

PROPERTY OWNERSHIP

Redacted

Submitted: 20 May 2025

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review

Date: 20 May 2025 10:19:15

I am contacting you as a result of my disappointment at the decision to disproportionately impact second home owners with the Council Tax hike .

I have a property at

Redacted

It is solely used by myself alongside friends and family for holidays .

I do not rent out my property so make no additional income, I contribute less to rubbish collections and have no requirement for schools.

I do however bring additional income to the island at local businesses which I support.

These businesses will certainly be affected by the certain reduction in 2nd home owners.

There should be more research carried out to confirm this rise is proportionate to the gains to the Island .

I am Redacted

Home address:

Redacted

Regards

Redacted

Sent from Outlook for Android

From: Redacted

To: Legal Postbox (shared mailbox)

Cc: Redacted

Subject: Island Communities Impact Assessment for Cumbrae in relation to the second homes council tax premium

Date: 20 May 2025 08:48:02

Dear Sir / Madam

Island Community Impact Assessment Review for Cumbrae

I want to add my opposition to this proposal based on my actual experience of being a resident of Cumbrae over much of the past 50 years.

First of all the drafting of this second homes legislation should have omitted those properties which could never be designated as "year round" or "family" homes due to the size and condition of the properties, particularly the high volume( 76%) of Band A and Band B flats that are currently second homes in Millport.

1. The majority of these 2nd home flats in Mill port are single room studio properties or derivations on the traditional tenement "Room and Kitchen" which in modern times are only suitable for a summertime weekend getaway for a single person or a couple

2. These Victorian construction, draughty, and poorly insulated properties are totally unsuitable for all year living, particularly in winter, due to their poor insulation standards leading to high running costs. The lack of gas on the island restricts the choice of heating systems for these tenement flats to inefficient (mostly old) electric heating systems.

a. No cost effective solution has yet been identified to effectively insulate these properties due to their size, construction type and period features

i. This is widely understood within the Carbon Neutral Cumbrae Project operating on Cumbrae

b. These properties remain expensive and uneconomic to heat in winter time, making them unsuitable for year round living,

2. These small flats could never house a family which is the intent of the "doubling of the council tax" to bring homes into permanent occupation

So properties at the lower end of the Council Tax bands should have been made exempt from this punitive tax or adequate funding identified to bring them up to a modern standard for year round living

Secondly the number of properties affected on Cumbrae is disproportionately much higher than any other community in North Ayrshire, and therefore specific mitigations should be in place for the community on Cumbrae

Thirdly as Cumbrae is an island covered by the Islands Act requires that an island specific impact assessment is prepared where a proposed policy is likely to have an effect on an island community which is significantly different from its effect on other communities.

Shops and businesses on Cumbrae benefit from weekend and part time residents including second home owners, and they add to the economy of the island. This policy contains no mitigations for the loss of business by second home owners abandoning properties affected by this punitive tax

These second home owners also ensure that old properties are in some effective use rather than remain derelict and unloved, which is a real risk that has not been considered within this policy.

The punitive nature of the double council tax will result in people being unable to sell these flats, and leave them un-occupied. The prospective result of this policy driving a higher than average "empty and derelict" properties onto Cumbrae has not been considered within the mitigations

The impact assessment carried out by North Ayrshire Council does not propose any improvement or mitigation against the identified negative impacts the policy may have on Cumbrae. It simply proposes monitoring the situation after the policy has been introduced to assess its impact.

I sincerely hope that this policy will be reviewed so that the real impact on the community on Cumbrae is taken into account. There is too much reliance on knee jerk policy and political objections to 2nd homes which takes no account of the reality on this small island. Please conduct an extensive impact review and amend this policy.

Thanks

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island communities impact assessment for Cumbrae

Date: 05 May 2025 22:03:06

To whom it may concern,

I have just read Redacted view on the second home council tax premium.

They are 100% correct in all their assertions. It is unfair that a small fragile economy is burdened so disproportionately. All this will achieve is a glut of low value flats being sold with no demand. Much of the property in Millport is unfit for full time habitation.

The second home owners that own the small flats in Millport have likely paid between 50 and 100K. Although owning a second home is a luxury, because of the affordability of the housing stock in Millport, it is a luxury that is achievable with a moderate income.

I would guess that most mortgages will be paying around £2,500 per annum. That's what ours is on our 60K flat. This plus council tax is £3,700. Pushing this up by 50% to 5K is unsustainable.

This policy will not achieve its objectives. There is already very weak demand for the housing, look at the prices. The housing is unstable for long term occupation. It won't raise much money, as people will sell up. It threatens to crash the Cumbrae economy and housing market.

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review (ICIAR) for Cumbrae COMMENT

Date: 06 May 2025 17:59:01

Good afternoon

As a second home owner with a property on Isle of Cumbrae (Millport) I want to comment on the impact the 200% Second Home Council Tax is creating. In no particular order as I consider each point is valid individually however combined the resulting impact is significant.

- Island Communities Impact Assessment Review (ICIAR) was not carried out properly and contravenes the National Islands Act as there's no evidence of any potential measures to counteract the damage the introduction of the 200% Second Home Council Tax has on the small island community on Millport Isle of Cumbrae.

- Second home owners, many having long established connection with Millport, contribute to the local businesses thereby maintaining these services/facilities for the permanent residents which would otherwise be at risk of limiting the availability of such.

- A significant number of second home owners are members of the local golf club which supports 3 full time & 1 part time members of staff all of whom reside permanently on the island. The impact of imposition of the significant increase on Council Tax may result in those members deciding not to renew their membership in future year (2025 year fees having already been paid) risking the viability of the golf club and potential redundancies. Not renewing due to property sale or financial affordability impact; paying 200% tax & membership fee from a limited income.

- Suitability of property types to address the housing shortage needs. A significant number of the second home properties are NOT suitable for families either due to size (one bedroom flats) or the condition (heat loss/ overall fabric of building) and will not address the housing needs.

- Supply and demand of suitable housing to address the housing shortage needs. Following the introduction of the 200% Second Home Council Tax the housing market in Millport has seen a surge of 1 bedroom flats coming onto the market. The demand for these properties does not match the supply suggesting these are not suitable properties to address the housing shortage in Mill port .... If indeed such exists.

- North Ayrshire Council has stated 10% of the additional revenue generated from the 200% Second Home Owners Council Tax contributions will be earmarked for affordable housing across the whole of North Ayrshire however there is NO direct or specific provision for affordable housing purely for Cumbrae. Therefore, the second home owners of Cumbrae, are supporting not their local community but paying into council services on the mainland delivering zero benefit for Cumbrae.

- Not aware what North Ayrshire Council plan to use the remaining 90% of the additional revenue generated from the 200% Second Home Owners Council Tax contributions. The lack of transparency needs addressing to ensure that the revenue generated is clearly identified, accountable and is NOT used to prop up NAC budget shortfalls.

Please acknowledge receipt of my comments and advise me if I will receive any feedback once the consultation period closes.

Regards

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities impact Assessment Review

Date: 19 May 2025 12:10:18

Dear Sirs,

I am writing to you in relation to the recent increase of council tax on second homes on the Isle of Cumbrae that is garnering media attention. At the time of the original consultation many people commented that doubling the council tax on the already damaged island economy would bring further economic decline for the island. When I refer to damaged economy I am making reference to the impact of covid that the island has yet to fully recover from and more recently the ailing Calmac ferry fleet that could not withstand the pressures of tourist season last year alongside the flood defence works.

At the last council meeting, the voices of many concerned members of the public were not heard when the decision to double the council tax was made. The meeting agenda was more focused on what the additional revenue into the council would be and how they would disproportionately deliver it across the wider community rather than support the area that the additional revenue was coming from. It was very apparent that the financial drivers for the local authority outweighed the concern for the local economy.

In some respects I could understand if all the additional funds from doubling the council tax was reinvested in the community of Millport however that was not the case and the island is taking a double hit on its economy.

As pointed out to the local authority previously. The incentive to double the council tax was to encourage second home owners to sell their property to families thus reducing the housing crisis across the constituency. However, this is not the case for the Isle of Cumbrae there is no demand for families to move onto the island so second home owners are having to sell to other second home owners as no families are wanting the properties on the islands.

There are a number of reasons for this.

The reliability of the ferries is a major factor, there are little to no job opportunities on the island for work and the jobs that are available are low to minimum wage.

Currently the investors on the island are the second home owners who use the shops and the pubs along with the day tourists however due to the increased costs for council tax the second home owners are naturally investing less into the economy and the impact of that is already showing. The council needs to understand that when you take an additional £100 a month out of the pockets of second home owners it does not deter the vast majority to sell their property instead they are spending less in the shops and public houses greatly effecting those whose livelihood depends on the businesses.

Eventually the decision to double council tax will tum Millport into a ghost town as the shops will close and the council will loose the rates revenue from the island so a short term gain will result in a long term economic crisis that the island will not recover from.

I respectfully ask that the local authority and the councillors listen to their constituents after all they are the people most affected by this ill thought decision.

Kind Regards

Redacted

Sent from Outlook for iOS

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities impact Assessment Review

Date: 19 May 2025 10:56:45

Dear Sirs,

I am writing to you in relation to the recent increase of council tax on second homes on the Isle of Cumbrae that is garnering media attention. At the time of the original consultation many people commented that doubling the council tax on the already damaged island economy would bring further economic decline for the island. When I refer to damaged economy I am making reference to the impact of covid that the island has yet to fully recover from and more recently the ailing Calmac ferry fleet that could not withstand the pressures of tourist season last year alongside the flood defence works.

At the last council meeting, the voices of many concerned members of the public were not heard when the decision to double the council tax was made. The meeting agenda was more focused on what the additional revenue into the council would be and how they would disproportionately deliver it across the wider community rather than support the area that the additional revenue was coming from. It was very apparent that the financial drivers for the local authority outweighed the concern for the local economy.

In some respects I could understand if all the additional funds from doubling the council tax was reinvested in the community of Millport however that was not the case and the island is taking a double hit on its economy.

As pointed out to the local authority previously. The incentive to double the council tax was to encourage second home owners to sell their property to families thus reducing the housing crisis across the constituency. However, this is not the case for the Isle of Cumbrae there is no demand for families to move onto the island so second home owners are having to sell to other second home owners as no families are wanting the properties on the islands.

There are a number of reasons for this.

The reliability of the ferries is a major factor, there are little to no job opportunities on the island for work and the jobs that are available are low to minimum wage.

Currently the investors on the island are the second home owners who use the shops and the pubs along with the day tourists however due to the increased costs for council tax the second home owners are naturally investing less into the economy and the impact of that is already showing. The council needs to understand that when you take an additional £100 a month out of the pockets of second home owners it does not deter the vast majority to sell their property instead they are spending less in the shops and public houses greatly effecting those whose livelihood depends on the businesses.

Eventually the decision to double council tax will tum Millport into a ghost town as the shops will close and the council will loose the rates revenue from the island so a short term gain will result in a long term economic crisis that the island will not recover from.

I respectfully ask that the local authority and the councillors listen to their constituents after all they are the people most affected by this ill thought decision.

Kind Regards

Redacted

Sent from Outlook for iOS

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review Cumbrae

Date: 10 May 2025 19:27:43

I write to comment on the Council Tax policy that North Ayrshire council is implementing on second homes. I agree that there is a need for more housing, particularly family homes for residents and workers on Cumbrae. Local businesses struggle to recruit and retain staff due to the lack of affordable rental and residential homes and I'm aware of local working families who can't get accommodation, people have had to leave the island because of this and the issue has been raised as a problem at many consultations including by the Scottish Government Islands Team and NAC while developing the Place Plan.

I attended a meeting of Cumbrae Community council at which local councillors explained to second home owners how they could circumvent the tax, either by renting out their homes for 70 days or by registering them as a limited company, so avoiding council tax altogether. I thus don't believe the policy will be effective & could actually result in a lower council tax take than before due to the publicity surrounding the exemptions. I would be interested to know how many properties actually pay council tax at the moment, i.e. how many already avoid council tax in this way.

The problem of lack of housing should be addressed in the first instance by building more council houses - I know NAC has made some welcome progress already with tis, however to solve the unique problems that the island has, the housing list would need to give priority to residents of, or workers coming to, the island. That perhaps would need a change of centralised policy, which could be defended given the circumstances specific to Cumbrae. There is also a need for 'sheltered' type housing for older people who could live semi-independently with some support and which may free up larger homes for families. There is no Care Home on the island so frailer older people stay on, often in accommodation unsuited to their needs, as the alternative is to leave Millport and family and friends.

Another effective way of releasing housing in the sho1t te1m could be to exempt self-catering holiday accommodation from the islands and remote areas hospitality relief, ensuring that properties that could be used as homes are contributing to the services provided. This may 'nudge' some on to full term rental availability or for sale to permanent residents but I appreciate could be politically controversial ( and very unpopular with self-catering accommodation providers). An alternative may be to have a limit placed on the number of self-catering licences issued on the island.

Should the double taxation policy still go ahead, there is a strong case for sub-categorising Band A properties. Band A council tax homes in Millport include 2-bedroom semidetached bungalows and 2-storey 2-bedroom apartments with sea views, so not all are small and unuseable as permanent homes, although a number will be. It would be reasonable to exempt small studio/single room-type second homes from double taxation, as these are often properties that have been passed down through generations of families and some current owners would genuinely struggle to pay. These types of holiday homes wouldn't lend themselves to permanent residency and there's a danger that we lose as regular visitors those families who are welcomed as long-standing members of the Millport Community and who undoubtedly contribute to the local economy, while still failing to release habitable properties for permanent residents. I appreciate this would be a time-consuming exercise but could be worthwhile as part of a survey of the standard of accommodation - much may already have been done as part of the Energy Efficiency scheme survey work on the island.

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review Cumbrae

Date: 19 May 2025 11:21:25

Good afternoon

I am asking you to reconsider the doubling of second home council tax for Cumbrae. My small one bedroom attic flat is in victorian conversion property. The bedroom is so small there is no way it would be considered as a permanent home. But has worked well as a bolt hole holiday home.

There are I'm sure many properties ,on the island, that fall into this category. You are charging me £2071.68 per annum for this Band A property. This is not sustainable and puts the island economy at risk, as home owners sell these properties.

On visiting the island I contribute to the economy by utilising the many small businesses that require the income provided by second home owners.

Please reconsider this tax increase before small businesses suffer the lack of income provided by second home owners as there is no way the population of c1300 would sustain these businesses.

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review for Cumbra

Date: 20 May 2025 22:29:51

To Whom it May Concern,

I am writing to express my concern regarding the implementation of double council tax charges for second home owners on the Isle of Cumbrae and would like to highlight the negative consequences this could have on our island community.

Second home owners play a vital role in sustaining the island's fragile economy. We, along with many other second home owners, regularly spend considerable amounts of money in local businesses---cafes, pubs, restaurants, and shops-which helps keep these businesses viable during off-peak seasons. This spending plugs the gap left by seasonal tourism, ensuring year-round economic activity. We know this because we frequently meet with other second home owners who share the same commitment to supporting the island community.

Contrary to the assumption that second home ownership restricts housing opportunities for locals, recent developments suggest otherwise. The council itself struggled to attract permanent residents to newly built social housing on the island. This indicates that there is not currently a high demand among local families or settlers to relocate here full-time. Therefore, second home owners are not displacing potential residents. The double council tax may force second home owners to sell their properties, which could result in an increase in empty homes and a decrease in off-season spending damaging the local economy.

Many second home owners have purchased run down properties/properties in need of repair and invested considerable time, effort and money bringing them back to a high standard, not only improving their condition but also enhancing the overall appearance of the island.

Our property, for example, was in a state of considerable disrepair when we purchased it. It required extensive upgrading, including a full central heating installation, full rewiring and a new roof-all completed at great personal expense.

We urge the council to reconsider this measure to support both full-time residents and responsible second home owners who are actively contributing to the island's wellbeing.

Yours sincerely,

Redacted

Sent from Outlook for Android

From: Redacted

To: Legal Postbox (shared mailbox)

Cc: Redacted

Subject: Island Communities Impact Assessment Review for Cumbrae - input from Millport Golf Club

Date: 12 May 2025 15:17:29

Dear council,

My name is Redacted and currently lead the management committee of the Millport Golf Club in the role of club captain.

I would like to provide you with some context around the role of the golf club within the island economy and the threat to the club's viability introduced by the additional tax on second homes.

Role of the club in local economy

Millport Golf Club is quite unique inasmuch as it serves as a tourist attraction here on the Isle of Cumbrae with less than 25 percent of our overall membership (i.e. fewer than 50 people) being permanently resident on the Island. It secures full time employment for 4 island-based employees, including 3 Greens staff ( one being an apprentice) - in particular the 3 Green staff would not be able to find local skilled employment if the club was to close for any reason. During the holiday season, the staffing requirements rise to cover Bar, Restaurant, Catering and Shop staff. Our income is largely from visitors and second home owners. Last year we had over 1500 tourists play golf here, all contributing to the wider local economy. A survey of our off-island members in 2022 indicated an average weekend spend of £250 across the Island's hospitality businesses and shops. This represents an annual contribution to the wider economy of around £800,000 providing much support to the ongoing viability of island-based businesses and helping provide ongoing job security for many island residents.

Other benefits to the community

Over the the last few years the island has lost many of its sports and recreational facilities, for example tennis courts and sailing centre. The golf club has managed to survive by encouraging participation across all ages and abilities. We work hard to give an all inclusive offering, including reduced cost mobility priority passes for our buggies to enable access, we offer Beginner and Returner Memberships for £200, Juniors up to the age of 18 are £50 per annum and the Cumbrae Primary School Children receive free membership to encourage a love of sport and enjoyment of outdoor activities. We offer Junior Golf lessons provided by trained coaches on Friday evenings through the summer months. In addition we provide facilities for the local archery club, curling club and our staff even cut the grass on the local park to make the football pitch playable.

Impact of additional tax on second home owners

While in many parts of the country it may be economically beneficial to replace second home owners with permanent residents, the likely impact on Millport Golf Club and consequently the island is quite the opposite. The golf club is primarily a tourist attraction.

The town is too small to support a golf course on its own - there would never be enough golfers and the cost would be too high. Second home owners on the island are essentially tourists who are guaranteed to come multiple times every year, bring friends and family and spend money. The majority of golf club members come from this population and their contribution to the club provides the foundation on which the club survives year on year.

Already some such members have put their flats up for sale and many are considering their position. It would be a tragedy if the island was to lose the golf course and all the associated benefits because of a tax that is designed to address a problem that affects a tiny minority of disparate locations elsewhere in the country. I suspect this was never the intention of the change in tax rules.

I would be happy to provide more details on costs and benefits or contribute in any other way to the impact assessment if required.

Kind regards

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island communities impact assessment review for Cumbrae

Date: 20 May 2025 22:37:21

Dear Sir or Madam,

I am writing in regard to the introduction of double community tax on second home owners.

The properties which are occupied by second home owners are mostly unsuitable for families to live in full time due to being old buildings which are difficult and expensive to heat.

We continually contribute to the island economy throughout the year not just in the summer months but having to pay double community tax would have a serious impact on the amount of money we would then be able to spend on the island. Second home owners play a vital role in sustaining the islands fragile economy.

Yours sincerely,

Redacted

From: Redacted

To: Legal Postbox (shared mailbox)

Subject: Island Communities Impact Assessment Review for Cumbrae

Date: 20 May 2025 21:29:32

Dear Sir/Madam,

I write in connection with the review of the island community impact assessment for Cumbrae relating to the 100% council tax premium on second homes to register my objection to the policy.